Exchange-traded funds (ETFs) are hugely popular with investors for good reason. Cheap, simple and transparent, they offer a straightforward source of exposure to a growing list of different investments, from stockmarkets such as the FTSE 100 to gold, oil, bonds and more niche strategies. ETFs can work well as the building blocks of an investment portfolio, both for beginners and those with greater experience.

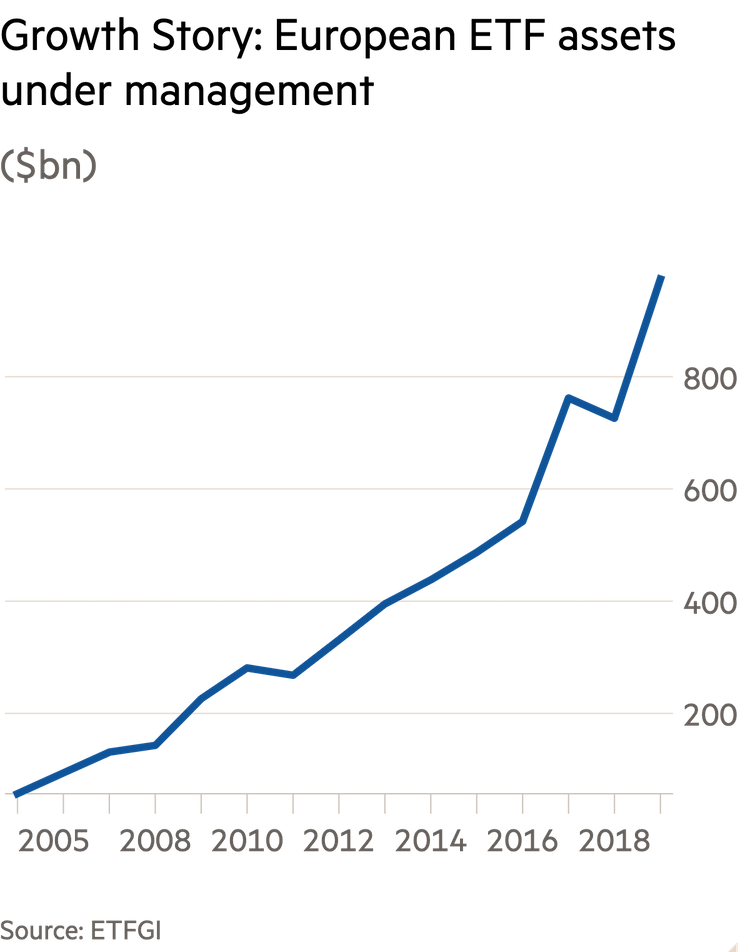

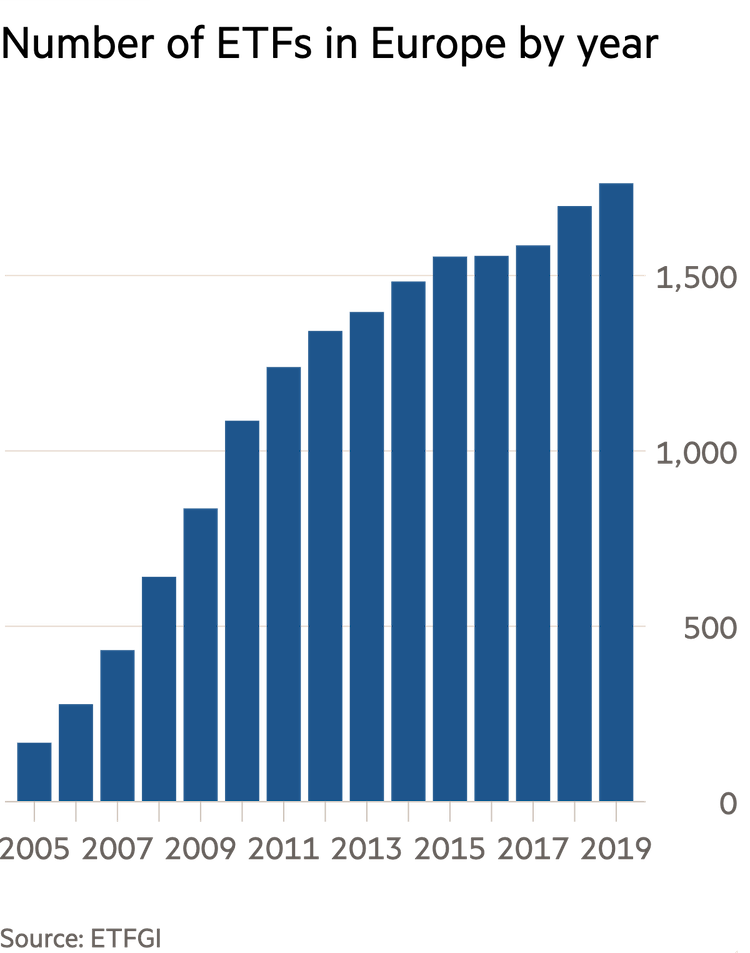

With investors increasingly favouring cheaper, simpler products, the ETF industry has exploded in recent decades.

As the chart shows, the amount of money held in ETFs in Europe has risen from $57bn in 2005 to $974bn at the end of 2019.

In this guide we'll help you understand how to make the best use of etfs

Jargon Buster

What are ETFs?

Confusing as investment industry acronyms can be, “ETF” is a reasonably straightforward term. As the “F” notes, these are investment funds that pool investors’ money and put it to work by investing in a specific market or asset.

Most ETFs will take a passive approach, meaning they seek to replicate the performance of a specified market by creating a portfolio that exactly mirrors it in terms of composition. For example, a conventional FTSE 100 ETF will invest in every company listed on that market, with the ETF’s position sizes dictated by the proportion of the market each company represents at a given time.

ETFs can also, in some cases, focus on individual investments. Gold ETFs, for example, can simply buy the precious metal and will perform broadly in line with moves in the gold price.

ETF shares

The “ET” part of the acronym refers to the fact that ETF shares are listed, and traded, on stock exchanges. This means that you can buy or sell an ETF’s shares whenever the relevant market is open.

ETF share prices can rise and fall throughout the day, and normally move roughly in line with the market value of their underlying investments. Savvy investors can potentially take advantage of this by buying in at a low price and selling after it rises – though the risk of attempting this is that you end up on the wrong side of a share price move.

The London Stock Exchange (LSE), among others, offers a wide variety of different ETF shares.

17

Number of exchange-traded products newly listed on LSE in April 2020

1,262

Number of ETFs available on LSE in April 2020

£12.8bn

Value of exchange-traded product trades in April 2020

£54.9bn

Value of LSE exchange-traded product trades in first four months of 2020

Choices, choices

Many ETFs take niche investment approaches, either to give you an edge over the market or to conform with investor preferences.

The growth of the ETF market, and the evolution of investor demand, has resulted in the proliferation of funds that, rather than tracking traditional markets such as the FTSE 100, track indices specially designed to focus on a preferred metric.

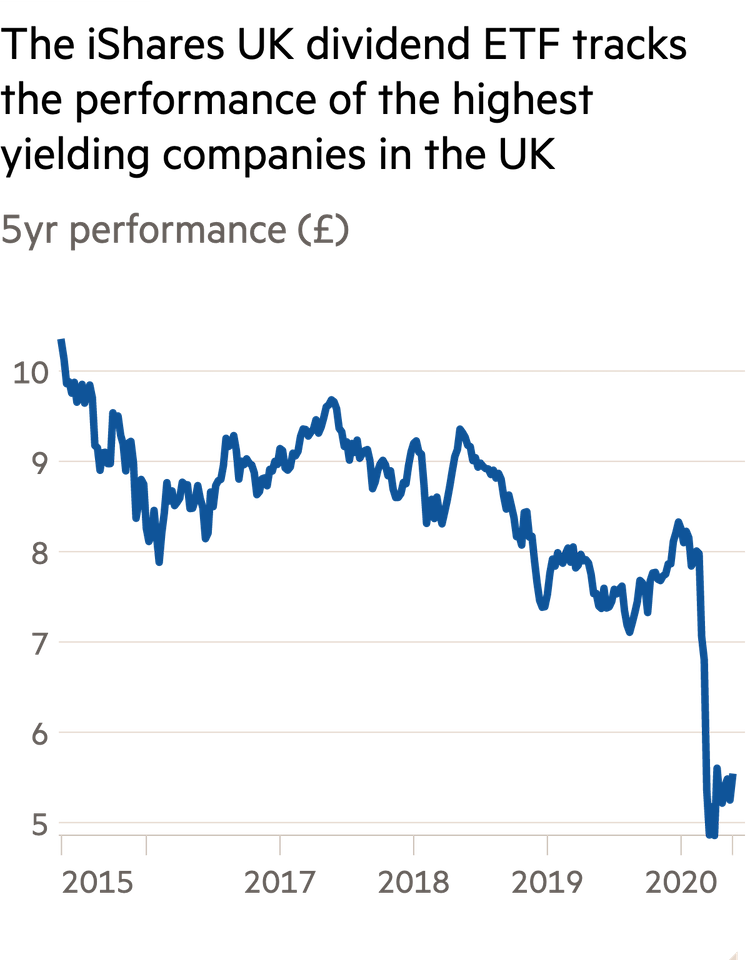

This approach, sometimes referred to as “smart beta”, can take many forms. Some indices, such as iShares UK Dividend Ucits ETF, will focus on a basket of stocks that pay an attractive dividend. Others will focus, for example, on stocks that look cheap within a certain market based on a specific set of metrics.

Some ETFs are targeted at specific sectors, such as banks or healthcare. ETFs can also be used to take a thematic approach to investing, from using an ethical slant to focusing on trends such as the growth of digital services. ETFs tend to publish full lists of their holdings, so you can take a look at what exactly you are buying.

UBS MSCI World Socially Responsible: Buys a basket of global stocks, but with a focus on those taking a socially responsible approach.

Lyxor Global Gender Equality: Invests in an index of 150 companies from around the world that score highly for gender equality, based on 19 criteria set by Equileap.

iShares Ageing Population: Focuses on companies that deliver products and services to those aged 60 or over.

iShares Digitalisation: Invests in a set of businesses around the world that generate significant revenues from digital services.

step-by-step guide to buying etfs

1. Get going by choosing a platform

First off, investors must choose an online platform or broker that offers ETFs. These platforms vary in user-friendliness and price. Some generalist platforms will focus on a wide range of investments including ETFs, company shares and funds, while others have more of an onus on trading that can encompass shares (including ETF shares) and other assets such as currencies. Most permit investment via an ISA, others offer SIPPs. It’s best to hunt around to find a platform which suits your own personal needs.

When you're getting going, remember to consider:

- How wide a range of ETFs do you require?

- How often are you planning to trade?

- Would you like to make other investments (in funds, for example) using the same provider?

2. Choose your investment wrapper

The most tax-efficient ways to invest are via an ISA or a SIPP, and your choice will likely depend on when you need your money.

If you are looking to top up or take control of your pension pot, a SIPP will give you tax relief of 20 per cent on your contributions (up to a yearly allowance of £40,000), or 40 per cent for higher-rate taxpayers. However, this is a long-term investment, and you will not be able to access your retirement savings until the age of 55 (or 57 from 2028).

You have much greater flexibility with a stocks and shares ISA in terms of getting access to your money, but you won’t receive any tax relief when putting money into it. However, you are not required to pay tax on capital gains or dividends paid within your ISA.

3. Pick your ETFs

Your ETF selection criteria should include not just where you want to invest, but how competitively priced the ETF is and how effectively it tracks the relevant market. And with a huge number of ETFs on the market, one good starting point would be Investors Chronicle’s list of Top 50 ETFs.

In consultation with a specialist panel, we work every year to identify the best options when it comes to ETFs that will form the core of your portfolio, as well as the options that promise to give your portfolio an edge or align with your views of the world.

A subscription to Investors Chronicle can also help you keep up with trends in the market and the broader ETF industry.

FAQs

Are ETFs risky investments?

The sheer unpredictability of investing means you can risk losses, and ETF share prices can be volatile. But buying an ETF that tracks an entire stockmarket is arguably less risky than investing in a handful of company shares.

Do I need to be a trader to use ETFs?

While you can use ETFs to take advantage of market moves, there is no issue with buying into an ETF and holding on to that investment. Avoid trading too often will reduce risks and make your life simpler – but if you wish to buy and hold it may be better to invest using a generalist investment platform rather than one focused on trading.

Are ETFs better than mutual funds, such as unit trusts and Oeics?

This can depend on costs and how often you would like to trade. ETFs are often cheaper, but a temptation to trade often may lead you to rack up further costs. You are also taking greater risks, though for some this is a strategy that might pay off.